Read time: 9 minutes

What’s been happening in the SaaS sector over the last 3 months?

Our Buyer Intelligence platform has been continuously tracking first-party buyer signals across our database, bringing you timely insights in the form of our latest SaaS intent report.

Our mission? To help tech vendors keep their demand generation strategies tightly aligned to real market demand.

Published quarterly as part of our category-specific intent reports, our latest blog takes a deeper dive into the shifts most likely to impact your SaaS market campaigns — and how you can action these insights to drive success.

Ready to level up your strategy? Let's go...

This quarter vs last quarter: what’s changed?

SaaS buyer behaviour didn’t just evolve over the past quarter; it recalibrated.

Comparing intent signals across Q3 and Q4 2025 reveals a clear shift in how SaaS buying groups approach decision‑making heading into Q1 2026. In Q3, buyers were grappling with integration challenges, cost pressures, and expanding SaaS portfolios. By Q4, priorities sharpened. Buyers became less focused on surface‑level capability exploration and more intent on execution, accountability, and long-term value.

Here are the 4 key takeaways:

From cost to complexity

Cost pressures have eased as the primary concern. Buyers are now more focused on implementation complexity and execution risk, especially among mid-level decision makers and senior budget holders.

Evaluation is becoming more commercial

Research is shifting faster into pricing models, vendor comparisons, and commercial justification, indicating earlier shortlisting and tighter scrutiny.

Decisions focus on long-term performance

Decision-stage research has moved beyond onboarding toward implementation roadmaps, performance monitoring, and optimisation, signalling greater accountability for value delivery.

Security is expected, not differentiated

Security and data privacy remain critical, but they’re now baseline expectations. Buyers want clear proof and credibility, not generic reassurance.

Market snapshot

Here's what our latest SaaS intent report reveals about the current market:

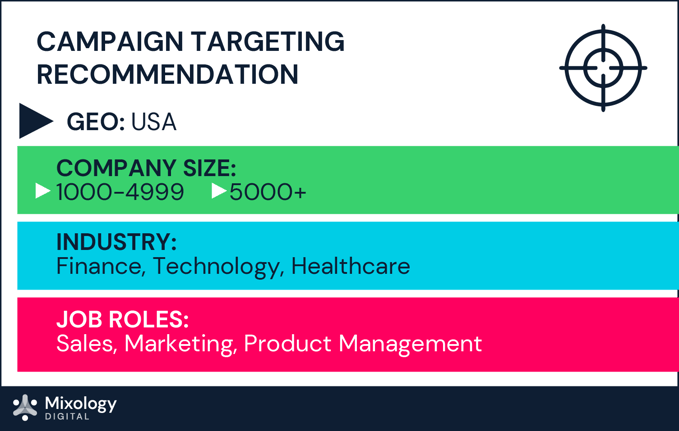

- Interest is strongest in the finance, technology and healthcare industries.

- Traction is highest among enterprises with 1,000–5,000+ employees.

- Sales, marketing and product management roles show the greatest engagement with SaaS topics.

From insight to impact, here's how to apply our insight into your campaigns:

Targeting and segmentation action points:

1. Segment enterprise organisations in surging industries and geos into priority tiers.

2. Within these tiers, filter intent signals among trending job functions to inform topic clusters.

Why?

Segmenting your market into priority tiers helps to focus go-to-market teams on the accounts most likely to convert. Further segmentation techniques such as topic clusters opens up opportunities to tightly align content to specific audience segments. The result? Relevancy at scale.

Research patterns at account level

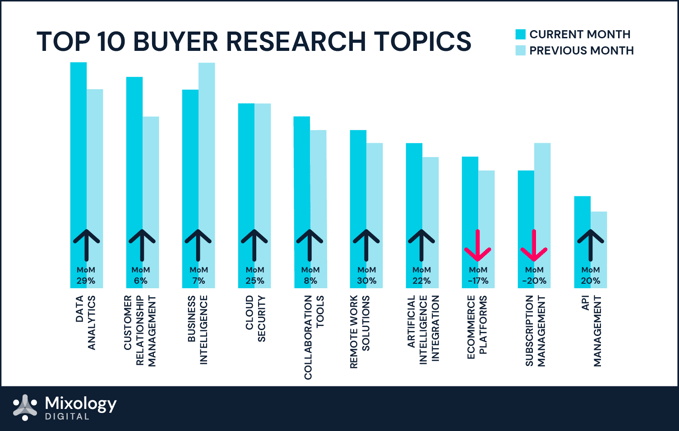

5 hot topics dominating research in the SaaS space (over the last 3 months), are:

- Data analytics – buyers want faster visibility and AI‑assisted insight; tools that plug into CRM/finance with minimal lift are being shortlisted.

- Customer relationship management (CRM) - stronger pipeline visibility by blending product‑usage and marketing data with configurable automations.

-

Business intelligence – increased demand points to a need for clearer decision‑making, reporting, and executive visibility.

- Cloud security- assurance for multi‑tenant data protection; SOC 2, SSO/MFA, audit logs and data residency are frequent asks.

- Collaboration tools - unified chat/docs/projects to reduce context‑switching; SSO and automated provisioning matter for hybrid teams.

The topic showing the greatest decline in popularity is:

- Subscription management with a 20% MoM decrease

What do these insights mean for your content strategy?

To keep your strategy aligned to market demand, we recommend:

-

Anchor awareness content around data analytics and CRM, focusing on how teams measure performance, improve visibility, and demonstrate ongoing value.

-

Develop mid‑funnel assets on AI integration and cloud security that reduce perceived implementation risk and reinforce operational credibility.

-

Use collaboration tools content to show how SaaS supports day‑to‑day productivity and cross‑team alignment in distributed environments.

Pro tip: Use AI/NLP tools (topic modelling, entity extraction, semantic clustering) to audit your content library against competitor coverage. Flag underserved subtopics (e.g. SaaS integration efficiency and user adoption optimisation) and build differentiated assets where demand is growing fastest.

Buyer group analysis

For SaaS buyers, complexity, cost, and scalability dominate decision-making. Our report shows the order in which buyers prioritise these factors depends on their role and seniority.

What does this mean for your persona development?

Tailoring content to buyer role nuances is critical for engagement and conversion. Here's how you can translate these insights into accurate personas.

Persona A: Influencers and researchers (typically Marketing Executives or digital specialists)

- Concerns: understanding how well a SaaS solution fits within existing systems and workflows. They spend significant time comparing vendors, feature depth, and technical capabilities to assess whether a platform will integrate cleanly and scale effectively.

- Content preferences: they want educational, detail‑led content such as blogs, comparison guides, and technical explainers that help them build internal knowledge and support early‑stage evaluation.

Persona B: Mid‑level decision makers (such as Marketing Managers and Sales Managers)

- Concerns: primarily concerned with business impact. They want to understand how a SaaS solution will improve efficiency, support teams day to day, and be implemented without disruption or excessive change management.

- Content preferences: they want use‑case driven assets, practical webinars, playbooks, and peer benchmarks perform well here, to help evaluate real‑world application and operational trade‑offs.

Persona C: Senior budget holders (such as CMOs, VPs of Marketing, Heads of Digital)

- Concerns: ROI, risk reduction, and long‑term value. They need confidence that a SaaS investment is credible, sustainable, and defensible at board level.

- Content preferences: they need outcome‑focused content such as case studies, ROI tools, and executive summaries that clearly demonstrate commercial impact and proof of value.

Action point: Create a persona matrix aligned to job functions. Map their pain points against the funnel stages they are most likely to participate in. For example, marketing leads may engage early (awareness content around SaaS benefits), while CFOs and COOs will respond to BOFU tools such as ROI calculators or vendor comparison toolkits.

Recommended reading: How to map content to the new buyer journey

3 SaaS demand gen plays:

Our AI Buyer Intelligence platform is able to interrogate research patterns by buyer stage. Here's how to action these insights into a full-funnel demand gen strategy aligned to real buyer behaviour:

Primary keyword focus:

- Cloud computing trends

- Benefits of SaaS solutions

- Digital transformation strategies

- Remote work technologies

- Data security in SaaS

How to use them: Build headlines and H1s around one primary keyword plus a contextual cue (e.g. industry, region, or business size).

Example: “How SaaS teams are reducing implementation risk and proving value earlier in the buying cycle”

Recommended plays:

- Publish a SaaS sprawl narrative quantifying hidden cost drivers (duplicate contracts, shadow it, data fragmentation) in buyer-friendly language.

- Create role-based messaging for security, finance, and IT on what breaks without governance to broaden internal sponsorship.

- Provide a lightweight portfolio health checklist to help prospects self-diagnose renewal and consolidation risk.

Assets to ship:

- 2 x blog articles

- 1 x infographic

- 1 x short‑form report

Copy cues: Lead with efficiency, simplicity, and accessibility. Avoid product-centric messaging; focus on value and outcomes.

Signals to watch: Look for early-stage research spikes, repeat visits, and increasing content depth as indicators of growing awareness.

Primary keyword focus:

- Comparative analysis of SaaS providers

- Pricing models for SaaS

- Customer reviews and testimonials

- Feature comparison charts

- Implementation strategies for SaaS

How to use them: Align mid-funnel content with buyer evaluation behaviour — focus on clarity, credibility, and proof through real examples.

Example: “How buying teams evaluate SaaS platforms for [use case]: cost, complexity, and delivery risk”

Recommended plays:

- Run a portfolio rationalisation workshop that outputs a consolidation shortlist and an integration priority order.

- Offer an evaluation rubric centred on interoperability (SSO, SCIM, APIs, exportability) and operational overhead, not feature depth.

- Deliver a change-impact map (processes, roles, training) so buyers can forecast adoption friction before signing.

Assets to ship:

- 1 x in-depth buyer guide

- 1 x evaluation-focused webinar

- 1 x implementation readiness checklist

Copy cues: Prioritise transparency. Make pricing models, scalability, and support terms clear. Use direct quotes, stats, or testimonials to validate performance claims.

Signals to watch: Look for multi‑asset engagement and role expansion within accounts as indicators that buying groups are actively evaluating solutions.

Primary keyword focus:

- Finalising SaaS contracts

- Negotiating terms with vendors

- Implementation roadmap

- Post-purchase support and taining

- Monitoring SaaS performance

How to use them: Build content around practical decision-making tools.

Example: “Finalising SaaS contracts: a practical guide to implementation planning, post-purchase support, and performance tracking”

Recommended plays:

- Provide a renewal and contract playbook: renegotiation levers, tier right-sizing, and usage governance to protect value post-purchase.

- Include an adoption operating model with owners, cadence, and usage KPIs plus a plan to reduce unused licenses.

- Offer modular commercial terms that allow phased rollout and future consolidation without punitive lock-in.

Assets to ship:

- 2 x case studies

- 1 x ROI tool

- 1 x vendor comparison asset

Copy cues: Prioritise credibility and clarity. Use quantified outcomes to reinforce confidence in purchase decisions.

Signals to watch: High-intent behaviour on pricing/contract pages, onboarding and support documentation views, and ROI/benchmark tool usage.

Tip: Keep the exact keyword phrases in page titles, H2s, alt text, and internal links so performance teams can tie content to intent spikes and prioritise syndication/remarketing accordingly.

Ready to activate these insights?

Why not try our demand gen planning framework? It’s a collection of templates and planning aids, including:

- Buyer group intent mapping

- Multichannel campaign blueprint

- Funnel‑aligned strategy shortcuts

Everything you need to turn category intent insights into campaigns that convert.